Your customer acquisition cost is the third most important statistic about your business.

That’s according to NFX , a venture capital firm that specializes in investing in startups.

CAC ranks third on their list of the five most important startup metrics they look at before they invest. For perspective, retention rate is number one, and growth rate is number two.

But CACs are getting higher and higher. If more capital was flooding into eCommerce, but the audience was staying the same size, we’d see normal cost inflation in advertising.

Instead, capital is flooding into eCommerce —but the audience size is shrinking.

That’s thanks in part to the iOS 14 update. The update reversed IDFA (Identifier for Advertisers) collection from being opt-out to being opt-in.

In plain English, that means more privacy for the users of the world’s 1 billion iPhones , as their information isn’t automatically being tracked and sold to advertisers.

But it also means that the playbook that has sustained digital marketing for the last ten years, like targeted Facebook and Google ads, is now nearly obsolete.

What little audience is left is getting more and more expensive to advertise to:

Marketing Drive reports the cost of conversations for eComm marketers surged by 200% in 2021 after iOS 14 came out

A tea seller in Oregon used to gain one new customer for every $27 spent on Facebook and Instagram ads , per the Wall Street Journal—but post Apple’s changes, their ad cost to bring in a new customer grew to $270

You can’t afford a tenfold increase in CAC.

So in this piece, we explore what to do about rising CACs, including providing four ideas to reduce your customer acquisition cost (CAC):

What’s CAC? And what’s a good CAC?

CAC = customer acquisition cost, or how expensive it is for you to bring on a new customer.

It’s calculated by dividing the money you spend on sales and marketing by your number of new customers.

Per that NFX video , it’s important to recognize that CAC isn’t just your advertising cost. It should include any expense required to land a customer, like the salaries of salespeople, marketers, and customer support folks. It could even include product development and improvement costs.

CACs can be hard to benchmark. As we wrote about in this article charting CACs’ pandemic-induced rise , acquisition costs vary widely by industry:

Travel has an average CAC of $7

eCommerce has an average CAC of $10

Financial services have an average CAC of $175

Not all CACs are created equal, so worry more about comparing your company’s historical CACs to that of your competitors (if you can even find them).

For instance, Peloton’s formula for calculating their new customer acquisition cost (NCAC, which we’re calling CAC in this article) before their IPO included subtracting their profit made from fitness subscribers from their sales and marketing cost, giving them a NCAC of $5:

By our standard formula—and the formula of most of the rest of the eComm industry—Peloton’s CAC would actually be $1,056, not $5.

Here’s another recent one, if you’re looking for an example CAC, this time in the entertainment industry: the Motley Fool calculated Roku’s CAC as $95 in 2021 .

CAC-reducing tactic #1: Invest in more affordable marketing with better payoffs

Wouldn’t it be lovely if I had a magical new marketing channel to share with you that would be 100% effective with your target audience?

I don’t, unfortunately.

There’s no one-size-fits-all marketing channel. Your customers might be hanging out on Instagram, or TikTok, or LinkedIn.

But wherever they are, you should be hiring other people to talk to them on your behalf.

That’s right: a great way to reduce CAC is to use influencers.

We’ve written about influencer marketing before: here’s a primer to what it is , and here’s a deep dive on nanoinfluencers and the future of the field .

Per consumer brand expert Nik Sharma, who was the former Director of Performance Marketing and then Director of DTC at flavored water company hint , working with influencers dropped the brand’s CAC by 40% .

Influencers reduce CAC, per Sharma, because they drive down the cost of content production.

Instead of paying an ad agency or an in-house creative team for a snazzy video, the influencer makes it all themselves—they plan, write, edit, film, and post the video.

Here’s Sharma’s advice on how to get started:

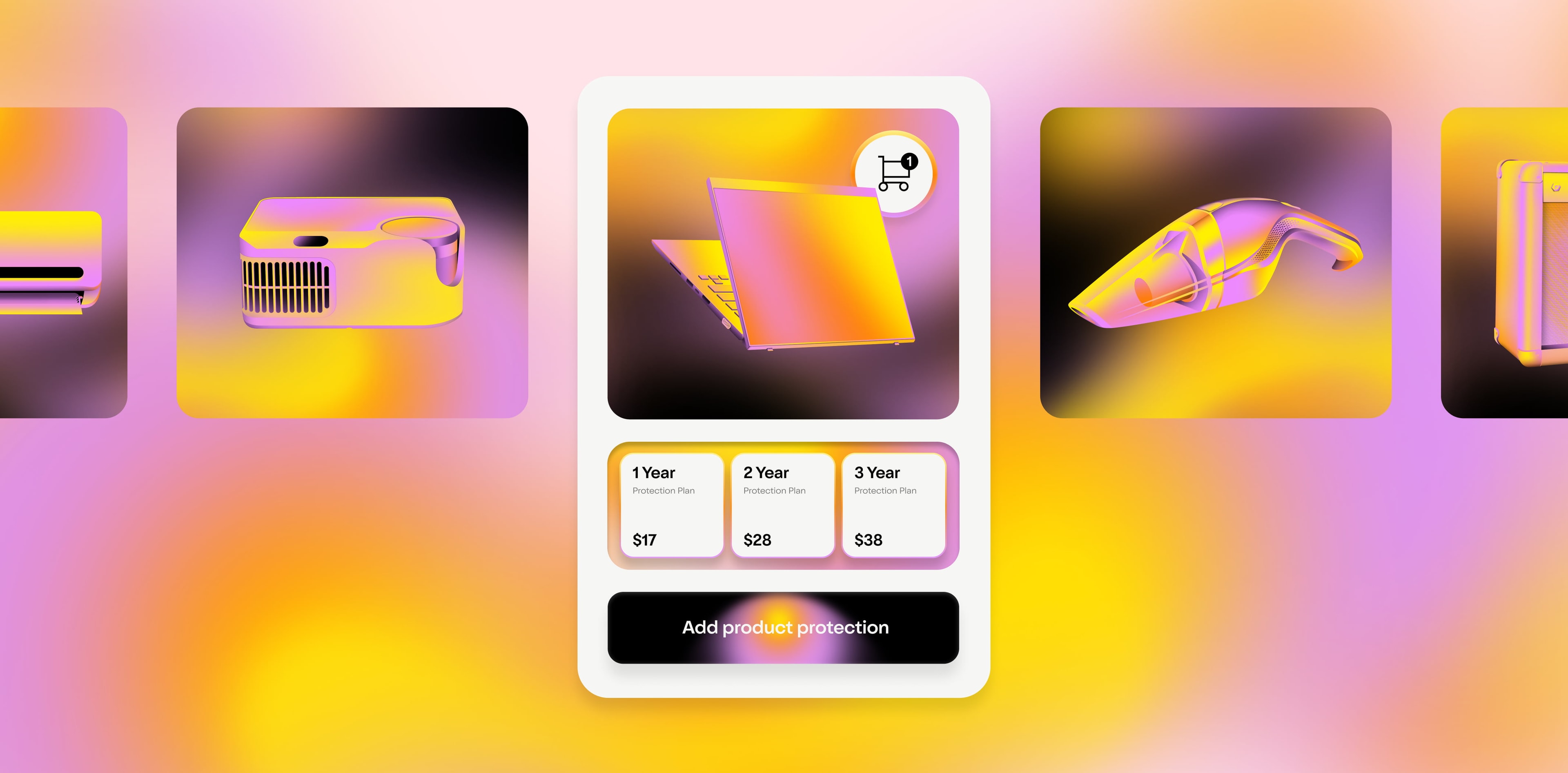

CAC-reducing tactic #2: Make sure your product pages are primed to convert

Even if all your ad spending dollars work to bring customers to your website…

…are you ready to convert them from browsers to buyers once they’re there?

A 2019 Salsify survey found that as much as 69% of shoppers will abandon a product page if it doesn’t have enough information or details about a product.

That’s even higher than the percentage of buyers who will bail because a price is too high.

Boost your CAC by turning more website visitors into buyers. Do that by applying product page best practices, like these shared by conversion-optimization consultancy Oddit in this thread :

Customers care about free shipping—so if you offer it, make that clear

Focus on your product with a primary image that takes up 75% of a mobile device screen

Lean into social proof with review counts, star ratings, and user-generated content (UGC)

Stagger your CTAs into a primary action like “Shop Now” and secondary actions like “Read More”

Give primary actions brighter graphics and buttons

CAC-reducing tactic #3: Embrace referral programs

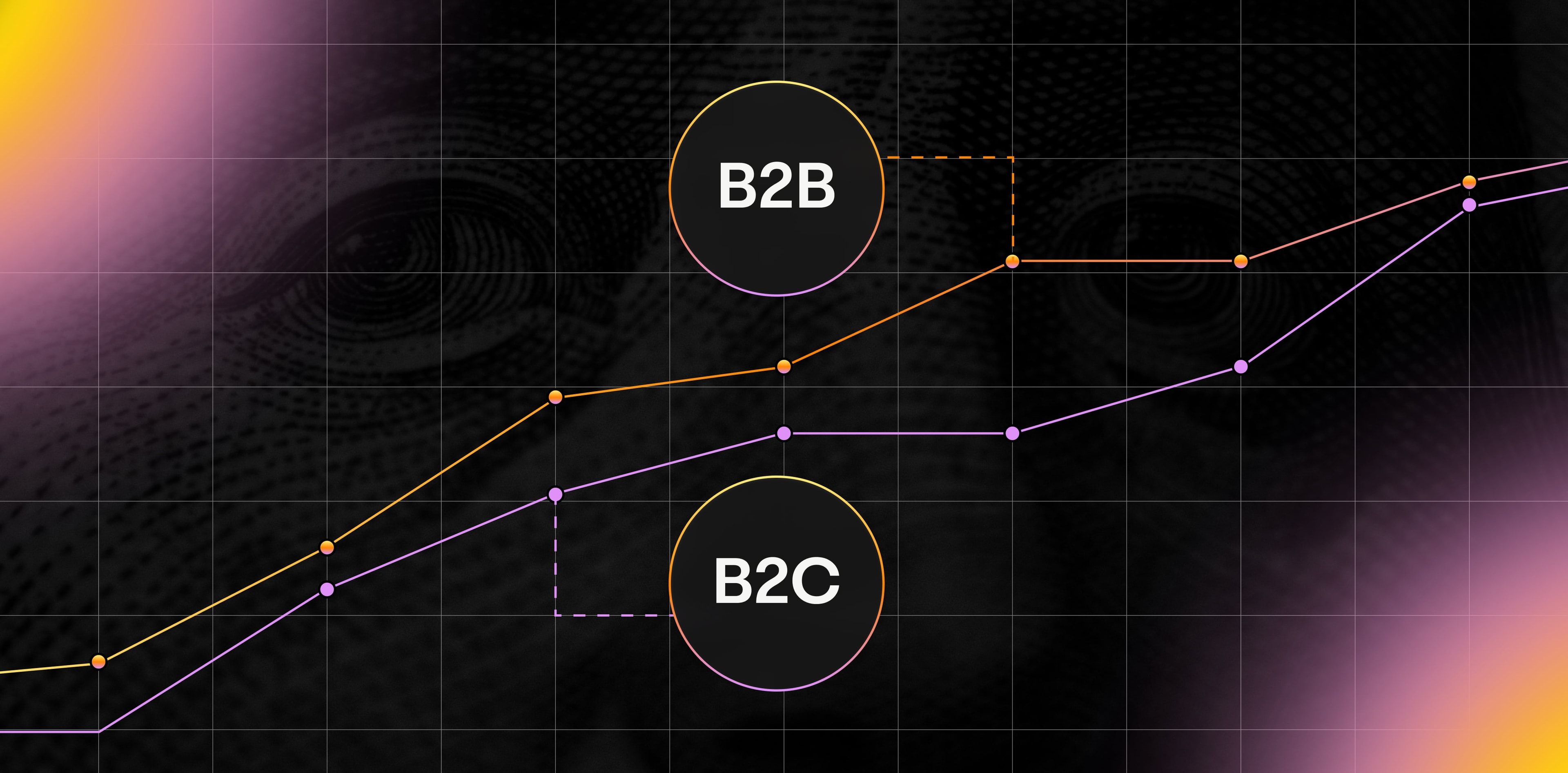

ARK Investment Management included the following chart in their Big Ideas 2021 presentation on large-scale investment opportunities.

The research came from their whitepaper on the rise of Cash App and Venmo , and it shows how important lowering CAC can be.

A credit card customer might cost $1,500 to acquire. (Think of the cost of free cash promises if you spent a certain amount, or of expensive Superbowl ads.) Checking accounts are expensive, too, since banks have to maintain leases and staff to help people set them up.

Their presentation is clear about why digital wallets like Cash App are crushing their more traditional competitors when it comes to CAC, crediting their low acquisition cost to:

“viral peer-to-peer payment ecosystems,

savvy marketing strategies,

and dramatically lower cost structures.”

You might not be a financial product, but a solid referral program can help drive your CAC down.

Consider these reach-expanding ways to acquire new customers by utilizing the networks of your existing customers, inspired by Cash App:

Run giveaways on social media, like Cash App’s now-famous giveaways on Instagram, where they ask followers to share the post in order to win stock or cash

Send free product to customers who invite their friends to check out your product page or join your email list

Launch an exclusive referral program with special prizes, i.e. custom, unpurchasable merch for referring five friends

Reward high-value referrers with personalized, special touches, like thank-you letters or a trip to your headquarters

Or check out these other best-in-class referral programs from leading companies.

CAC-reducing tactic #4: Build a retention marketing machine

A study on 2021 marketing trends found that customer acquisition is the top priority for 65% of marketers.

That makes sense. Bringing new customers in the door more cheaply is what we’ve talked about for this entire article, after all.

But what about focusing on keeping the customers you already have?

About surprising and delighting them on the regular?

And about seeing increased average order values, purchase frequency, and brand loyalty?

It’s almost always cheaper to keep a customer than it is to get a new one.

Consulting giant Bain wrote a memo in 2001, when the world was going through another economic downturn , that highlighted the number-one way companies could keep costs down :

“Building loyal relationships with customers and other stakeholders.”

The memo shared a stat that’s been repeated all over the internet since: in the financial services industry, a 5% increase in customer retention produces more than a 25% increase in profit.

From the 2001 memo—and equally applicable today.

In summary

Retail eCommerce sales are slated to hit 5,908 billion USD in 2023, per Statista.

With more competition and less advertising data, it’s harder than ever to connect with new would-be customers.

But being creative about your acquisition channels can help drive down cost—and investing your savings in customer retention will pay dividends in the long run.

Remember:

Try influencer marketing to get quality content without breaking the bank

Make sure your product pages are optimizing for conversion

Roll out a referral program to leverage your customers’ networks

And invest in delighting your current customers

Successful brands and successful acquisition funnels, like Rome, aren’t built in a day.

But the Romans also didn’t have Clyde as a partner, so maybe you’ll break their record on that front.

SIGN UP FOR OUR NEWSLETTER