Merchants across the country have weathered lockdowns, record unemployment and whipsaw movement within the Consumer Confidence Index throughout 2020. In recent weeks, bullish projections for Cyber Week were met with lukewarm returns, but optimistic projections for economic conditions in Q121 began to arrive in the wake of vaccine announcements from Moderna, Pfizer-BioNTech and others. That is what makes yesterday's Consumer Confidence data all the more surprising.

Both the Bloomberg Consumer Comfort Index and the Conference Board Index reported slumping consumer confidence data across the month of December. The Conference Board index dropped to 88.6 from a downwardly revised 92.9 in November, according to a report from the group issued on Tuesday. For perspective, economists surveyed by Bloomberg earlier this month had called for an index score of 97. This aligned with Fed projections as well as encouraging employment figures. The Conference Board Index also conducted a survey in which respondents expected their incomes to increase in Q121, improving from a score of 16 to 16.8. Those marginal increases, however, appear to be no match for the dark cloud of COVID concerns hanging over the entire economy.

“Consumers’ assessment of current conditions deteriorated sharply in December, as the resurgence of Covid-19 remains a drag on confidence,” Lynn Franco, senior director of economic indicators at The Conference Board, said in a statement on Tuesday.

Not All Businesses Are Impacted Equally

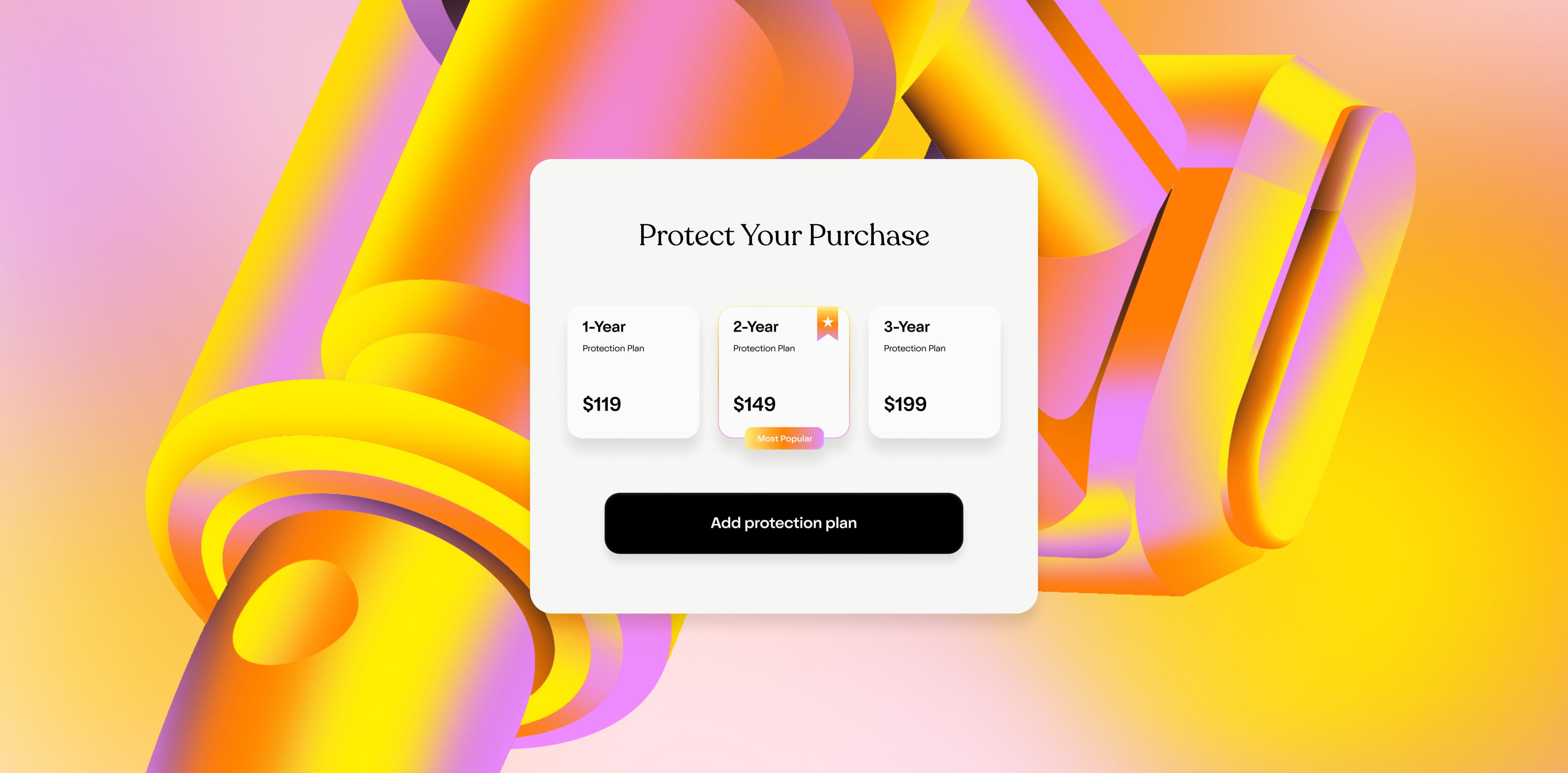

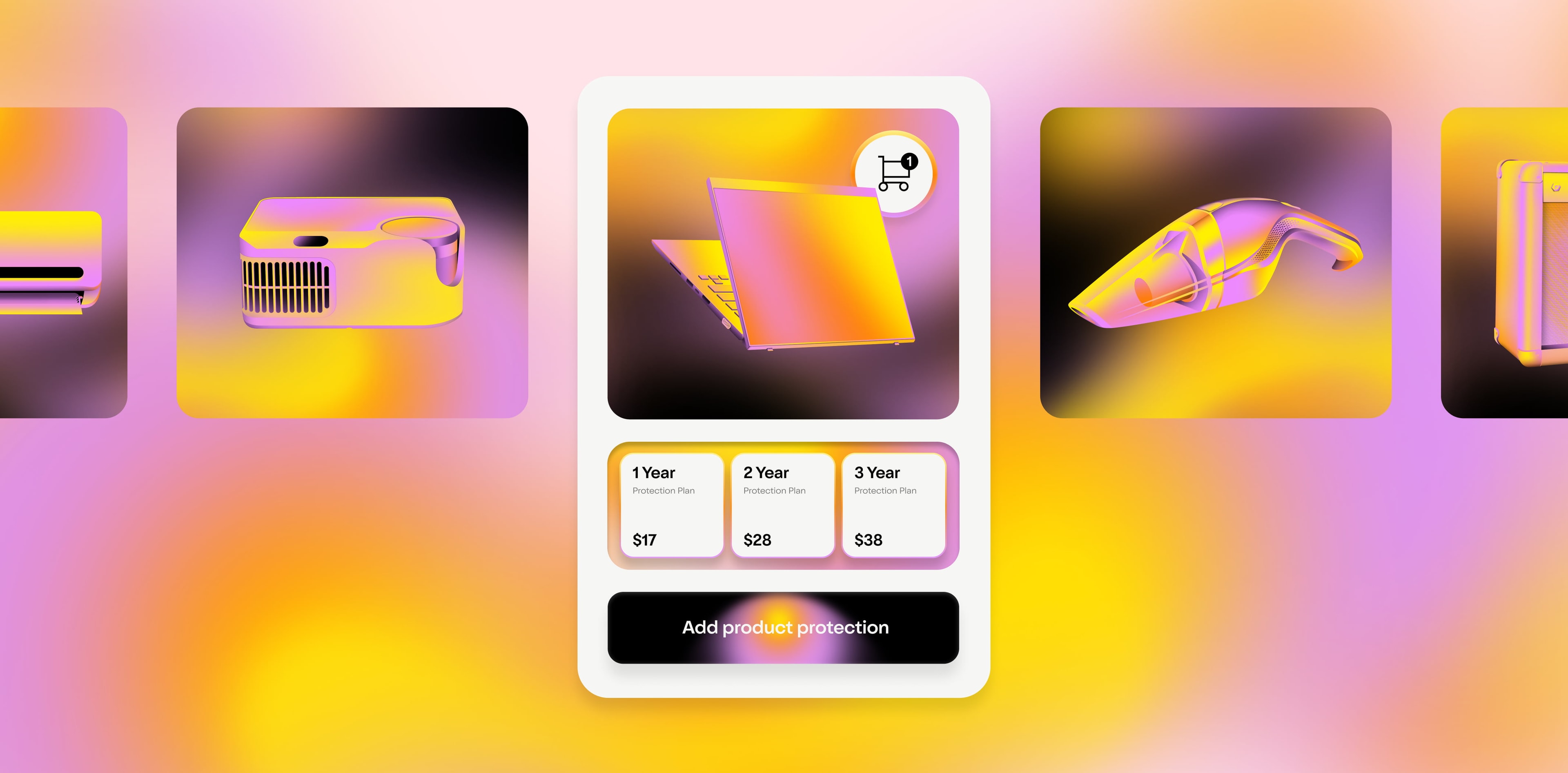

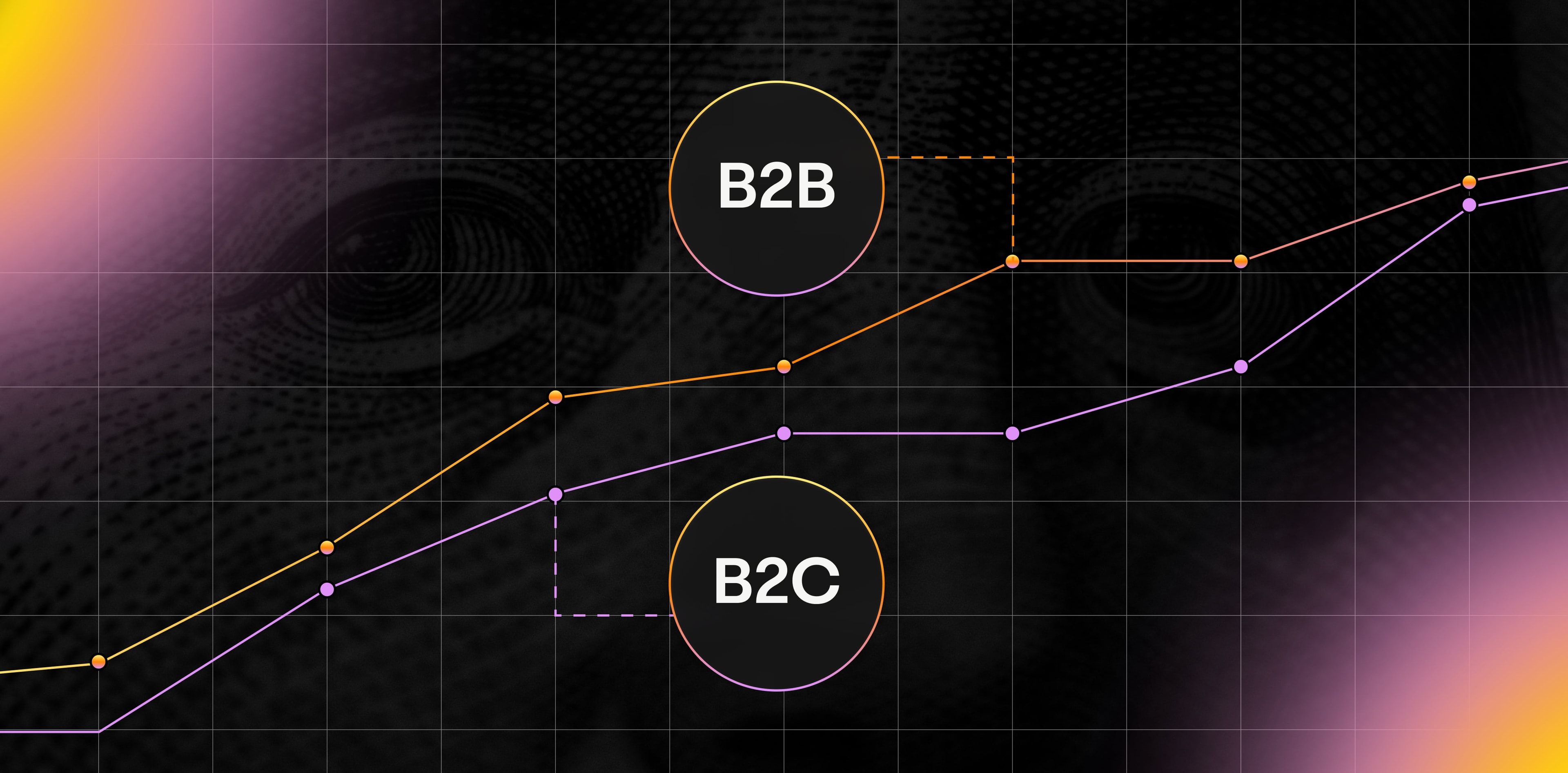

Speaking on Tuesday, Franco stated that economic factors are not impacting merchants equally. "As a result (of reduced confidence), consumers' vacation intentions, which had notably improved in October, have retreated. On the flip side, as consumers continue to hunker down at home, intentions to purchase appliances have risen. Overall, it appears that growth has weakened further in Q4, and consumers do not foresee the economy gaining any significant momentum in early 2021." According to an eCommerce study conducted by Ignite Visibility , despite current economic trends, “more than half of consumers plan to spend the same or more this December.” The study also found that companies offering free shipping and a speedy online experience were exponentially more likely to secure a purchase. Sixty-three percent of customers ranked either free shipping or a great website experience as their leading factor when it came to making a purchase decision. Clyde empowers businesses to offer extended warranties and accident protection to their customers, right from their website. Our plans slot into merchants’ current purchase flows, ensuring that their customers’ experiences remain top notch.

When Can We Expect A Recovery?

“An uncertain outlook is likely to weigh on sentiment until there is wide distribution of a vaccine, that will allow a more complete reopening of the economy,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. What does that mean for merchants in the meantime? It puts a premium on retaining current customers, while putting their CAC under a microscope in January and February.

How To Economize In A Tight Market

Our most recent post “Three Ways To Combat Rising Customer Acquisition Costs ” details the increased importance of implementing savvy and effective tactics geared at both attracting and retaining customers. We've laid out a holistic approach to combating CAC that involves much more than your marketing department. If you’d like to learn more about how your business can weather the coming months, click the link below.

SIGN UP FOR OUR NEWSLETTER