5 Challenges and 3 Easy Wins: How Brands Can Stay Ahead In The Current Economic Environment

Kermit the Frog has already cornered the market on lamenting the inevitable facts of life with “It’s Not Easy Being Green .”

Still, I think it’d be fair for modern retailers to note just how tough the current economic environment is.

“It’s Not Easy Being A Brand,” maybe? Can we do something with that?

In the third quarter of 2022, ecommerce vendors and retailers are facing 5 key challenges:

Inflation

Supply chain woes

Decreasing customer loyalty

Changing data and security laws

Budget cuts (and subsequent headcount cuts)

We’ll go into all of those challenges in more detail later on, but the headline is this: consumers have less money to spend, retailers have fewer products to offer, and everyone is trying to do more with less.

So what’s a brand to do?

They have to play under the banner of one main strategy: keep the customers they have and earn new ones. It all comes down to customer experience.

Within that, the most helpful plays for retailers are ones that they can implement immediately that aren’t costly. There are 3 easy wins retailers can start doing today:

Expand your reviews and social proof integrations

Offer different payment options

Add an extended warranty offering

5 key challenges facing retailers

1. Inflation

You know inflation is really happening when a line in the New York Times’ daily newsletter goes like this: “Inflation has pushed some ice cream truck owners to the brink .”

For those ambulatory sellers of sweet treats, prices are getting out of control. Per the article, diesel has topped $7/gallon, vanilla ice cream now costs $13/gallon, and a 25-pound box of sprinkles costs around $60, which is double what it cost in 2021.

Inflation is higher than it’s been in 40 years, according to McKinsey , thanks to a combination of factors:

Demand for goods that is outpacing supply as countries open back up

Higher production costs and slower supply chains because of pandemic-related shutdowns

Further squeezes on raw goods due to the war in Ukraine

And while most retailers plan for 2% inflation, many are unprepared for it to rise much beyond that.

They can raise prices, but customers won’t be able to take infinite increases. As McKinsey noted, in some categories — like travel and restaurants — consumers are already “paying more but consuming less.”

The International Monetary Fund doesn’t see the situation improving anytime soon, either. Their chief economist said this week that “the world may soon be teetering on the edge of a global recession,” and the organization downgraded its growth forecast for the year.

Instead of expecting growth similar to 2021’s 6.1%, the IMF now expects 2022 growth to top out at 3.2%.

Inflation will outpace growth at home and abroad: new inflation expectations are 6.6% in countries like the U.S. and 9.5% in emerging markets.

What’s a retailer to do?

2. Supply chain woes

We’ve reported on supply chain issues before. We probably will again — unfortunately, they’re not going anywhere.

As a reminder, current supply chain issues have evolved after:

Ports and factories shut down when the pandemic began

Public health mandates kept factories closed

Labor shortages slowed production when factories reopened

Consumer demand reached new highs thanks to built-up savings

A University of Rochester economist says that absent the Russia-Ukraine war, supply chains may have returned back to normal at the end of 2022 or early 2023. But instead, George Alessandria expects “at least another year of low growth, high prices, and bare shelves.”

And unfortunately, he also says supply chain issues aren’t directly causing inflation, so we don’t even have a convenient scapegoat for climbing prices.

“[Supply chain] factors are mostly transitory and can lead to a surge in prices, but they won’t cause prices to consistently grow 6, 7, or 8 percent year in and year out,” he says.

So even if your customers can afford your products — are you able to make those products and get them to them?

3. Decreasing customer loyalty

PwC’s 2022 Customer Loyalty Survey found that “volatility in consumer behavior is at an all-time high.”

Let that sink in.

Two and a half years into a pandemic, volatility is still reaching new highs. The sped-up transformations we’ve seen in digital commerce, consumption patterns, employment, and other major global forces continue to evolve and impact each other in new ways.

It’s no wonder customers are switching things up. Per the survey:

26% of consumers stopped using or buying from a business in the past year. The top reason why? Bad experiences, whether with products themselves or with customer service.

Even if they haven’t yet, 55% of consumers would stop buying from a company they otherwise liked if they had several bad experiences. 32% would stop after inconsistent experiences, and 8% would drop them after just one bad experience.

More than 30% of Gen X, Millennials, and Gen Z are likely to try a new brand this year. Baby Boomers are more loyal, or otherwise just change-resistant, coming in at 19%.

It’s never been more important to provide a great customer experience.

4. Changing data and security laws

Data matters to every part of a business’s strategy and operations. Data informs:

Who a retailer markets to

What products they make

Where they set their prices

What sales channels they invest in

And more.

But data is getting harder and harder to come by, and not for any of the reasons listed above. Data isn’t bound by supply chain difficulties. It’s not impacted by inflation. It’s not a finite resource at all, really. There’s more data out there than ever.

It’s just more difficult — and expensive — to access.

We go into detail in this guide , but as a high-level summary:

Several tech giants struck it rich with platforms that mined and sold user data (hi, Facebook).

That kicked off a new series of data privacy laws, including Europe’s GDPR and California’s CPRA. These laws protect user data and restrict how companies can profit from it.

Mobile phone makers followed suit, with Apple and now Google updating their phones’ operating systems to ask users to opt-in to data collection or to otherwise obfuscate their data.

First party data — or data that a business collects on its own customers — is more valuable than ever before. If a brand doesn’t know who their target customers are, they can’t begin to win them over.

5. Budget cuts (and subsequent headcount cuts)

This challenge is related to many of the challenges above. Per Crunchbase , more than 30,000 U.S. tech workers have been laid off in mass job cuts since January.

Facing slow growth, higher costs, and a rocky forward-looking picture, many companies, from Glossier to GoPuff, have had to cut staff.

And headcount isn’t the only line item getting stared at. According to Reuters , retailers are shelving new products, pausing new store openings and other internal improvements, and reassessing investments in new production facilities, amongst other things.

Call it a post-boom cooling. Or a valuation cliff that had been built up for years. In any case, brands are finding themselves with tightened belts and less players on the field as they try to create great customer experiences, and that’s a tall order.

3 easy wins for retailers to start implementing today

In an environment like this one, there’s only one place it makes sense for retailers to invest: customer experience.

Oracle, in their 2022 report on retailer challenges, calls it “the brave new world of buying” wherein “consumers seek out the best shopping experiences.” The tech giant notes that “retailers need to pivot to maintain their appeal.”

Oftentime, investing in improving your customers’ shopping experience means investing a lot of money. New websites are costly, for instance. Adding more customer support is expensive whether you do it by building widgets or adding headcount.

But there are 3 ways that retailers can win in today’s environment by prioritizing customer experience without having to spend.

1. Expand your reviews and social proof integrations

Want to convert more would-be buyers into actual buyers? Add some social proof to your website.

Per a Trustpilot survey , 68% of consumers are more likely to purchase a product if they see social proof, which can include user reviews, testimonials, and likes.

Get the most bang for your (metaphorical) buck by using integration tools that offer different kinds of social proof, like:

Star ratings on your homepage, which 86% of buyers say make them more likely to purchase, as well as your product pages

Testimonials, which 60% of consumers say influence them

Media mentions, which 52% of consumers say are effective

Many social proof tools and integrations, from TrustPulse to ProveSource, have free trials or free plans for limited users, before charging monthly fees between $5-60.

Even with a low marketing or CX bucket, brands can get started on adding more social proof and should start to see solid payoff without spending much at all.

2. Offer different payment options

Credit card. Google Pay. Cash. Direct debit. Buy now, pay later (BNPL). There are a myriad of ways that your customers might want to pay for your products.

Are you letting them?

Adding new payment methods to your site does require ensuring you have the right payment gateways set up. And you will have to pay a fee, either a percentage or a per-transaction fee or both, to different payment processors, like PayPal or Amazon Pay.

But they don’t cost anything to set up!

So if you’re not accepting all kinds of payment methods, you’re missing out on sales, even if you have to give a portion of said sales to the payment processor. Keep in mind that some of the most popular payment methods in the States are, in order :

Credit card

Digital wallet

Debit card

Bank transfer

BNPL (more on how this works — including the pros and cons of offering it — here )

Direct debit

Cash on delivery

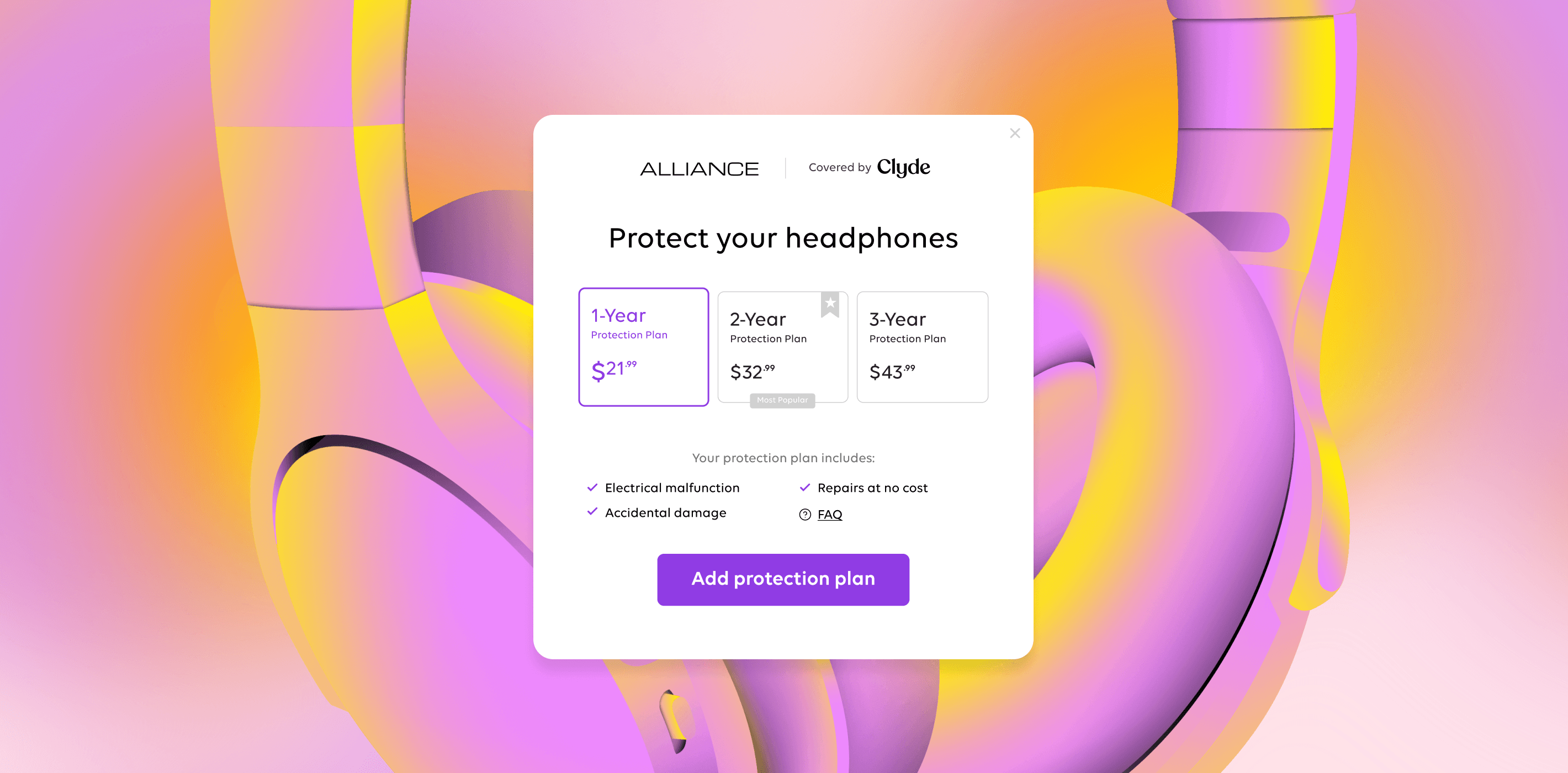

3. Add an extended warranty offering

Offering an extended warranty for your customers to buy can help give them peace of mind. They know that even if life happens, they’re covered.

That’s why warranties can play a major part in an overall ownership enrichment strategy that centers your customers’ experience and goes above and beyond to make the process of buying and owning your products the best one yet.

Extended warranties have other benefits , including:

Helping you skirt supply chain issues by facilitating repairs

Giving you access to more first-party data through registrations

Lowering your customer acquisition cost by increasing brand loyalty

And the best part? You pay nothing to get started. Or you shouldn’t, anyways. With Clyde’s extended warranty product, you invest nothing upfront beyond a bit of your time.

Clyde’s customizable warranty offerings can be integrated into your checkout flow almost immediately, and you’ll start seeing ROI the moment you sell a contract.

(Which may be even sooner than you think — Clyde’s average attachment rate is 18% , over four times the industry average.)

Set yourself up for success

For many brands, the next few months will be difficult. They’ll have less marketing money to spend trying to get a share of consumers’ reduced disposable income while working with reduced headcount, increased competition, and higher costs.

But brands still have some options in their back pocket, including a few low- or no-cost moves that can help them stand out from the crowd without blowing out their budget. Those include using more social proof, adding more payment options, and offering extended warranties with Clyde.

Ready to get started on improving your customers’ experience without breaking the bank? Set up a Clyde demo today.

SIGN UP FOR OUR NEWSLETTER