At Clyde, our goal from the very beginning has been to help our merchants operate their businesses more effectively while generating additional revenue. And while we are proud of the technology we’ve built and the service we provide, we understand that warranty and product protection programs are just one piece of the puzzle.

Remaining competitive within the eCommerce industry requires merchants to work with a host of third party vendors. A point of emphasis for us in 2022 will be to help our merchants connect with as many impactful vendors as possible within our hub. Merchants can gain access to critical technology and expertise which will allow them to leverage their data to achieve their business goals.

In our on-going series, we’re spotlighting our growing list of partners who are helping merchants all over the country. To kick off this series, Katapult's CEO, Orlando Zayas, was kind enough to explain why so many merchants utilize their services, while answering a few of our questions as well.

An Introduction To Katapult

Katapult (NASDAQ: KPLT) is the leading omnichannel lease-purchase platform, providing alternative solutions for retailers and consumers. As a financial technology company, Katapult provides cutting-edge technology that integrates seamlessly with online platforms, enabling our retail partners to expand their customer base, increase transactions, and grow revenue. Katapult's consumer-centric focus ensures an efficient application and approval process while providing transparent and tailored payment terms. Katapult partners with hundreds of retailers across the United States and millions of approved consumers to create new opportunities for point-of-sale transactions.

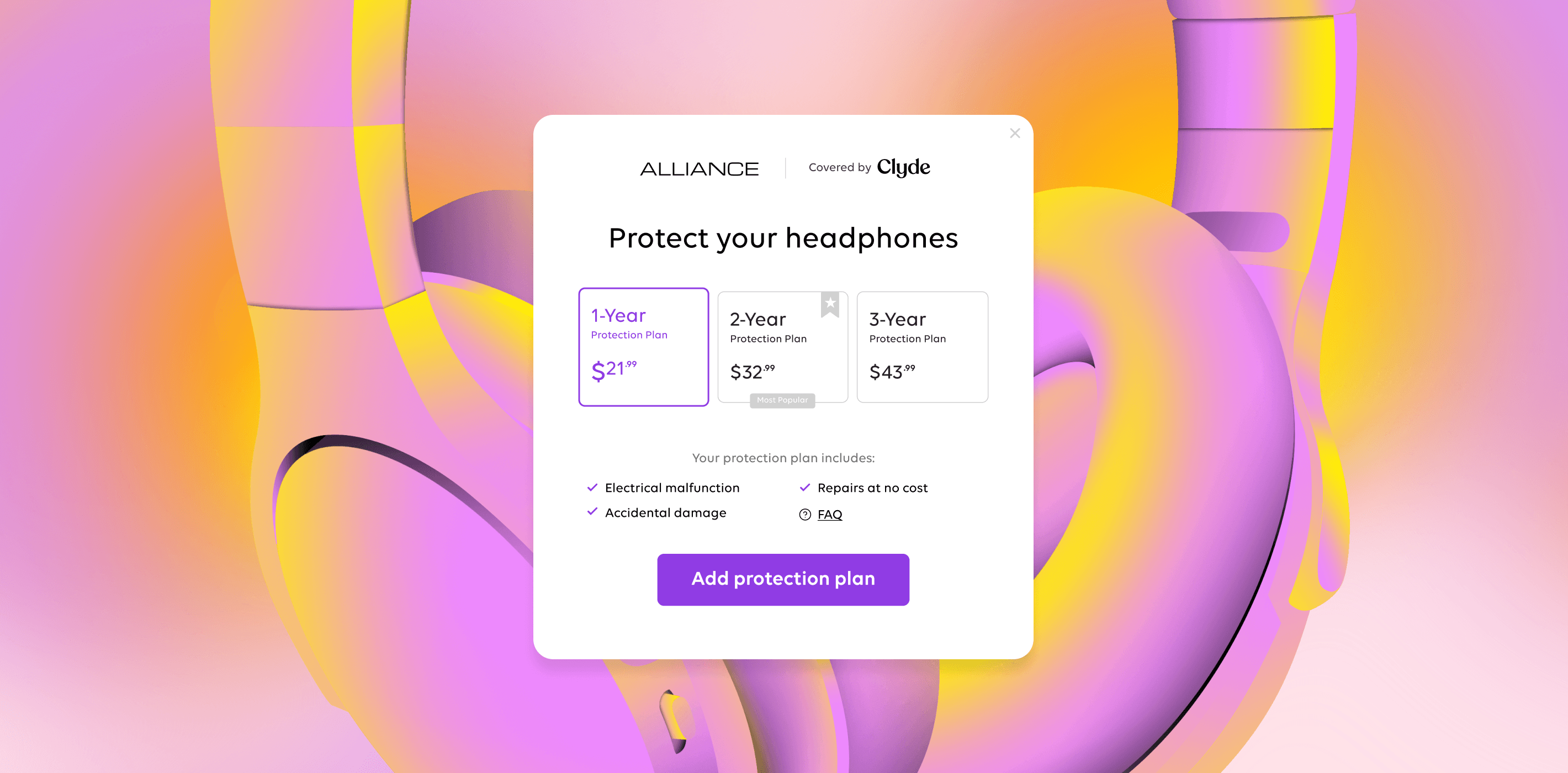

Our partnership with Clyde enables retailers to better serve nonprime consumers by offering a checkout experience in which shoppers can easily lease-purchase goods and add an extended warranty plan. Using Clyde and Katapult together, consumers can pay for their product and extended warranty over time, with the extended warranty portion not subject to lease related charges.

How much education is required for consumers to understand your product? Has the BNPL boom done the educational work for you?

Although the BNPL boom has helped educate consumers on the many options now available at checkout, it has not completely educated the consumer about lease-to-own options. While similar, BNPL and LTO are two very different solutions. Our whitepaper illustrates the differences between BNPL and LTO. There is still a long way to go in changing the narrative around LTO through transparency and continued education for both retailers and consumers.

For the merchants you work with, is there any risk associated with these programs and if so who bears those financial risks?

As with other checkout solutions, there is a fraud and non-payment risk with any transaction. Katapult mitigates fraud risk as much as possible with proprietary artificial intelligence and machine learning to identify and vet out fraud applications and approve qualified candidates. When it comes to non-payment or returning items, Katapult takes on that responsibility as the consumer who started the lease agreement with Katapult is now our customer and our first priority is to treat each customer with respect.

From a data perspective, are you able to quantify the number of customers that your tech/financing unlocks for eCommerce merchants?

We can’t share specific numbers of customers that Katapult brings to each of our retail partners, but can share that we maintain our own database of approved applicants to whom we then market our retail partners to encourage return to cart, checkout, and repeat purchase behavior. We worked with PYMNTS.com this fall on a consumer survey that attempted to quantify how many customers were sitting on the sidelines without the benefit of access to BNPL and LTO options.

What are you most excited about in the next six months when it comes to your product and functionality?

We are excited about the new enhancements we’ll be bringing to our existing and potential retail partners that will not only help them capture more transactions but will also help Katapult continue its mission for consumer transparency and ease of use.

What are you most excited to see in the next 6-12 months in eCommerce space? Any trends? Predictions?

Orlando Zayas, Chief Executive Officer of Katapult

We are excited about the continued adoption of alternative payment options and the inclusion that creates for consumers. There are many opportunities for new offerings, partnerships, and an expansion of access to the growing number of online and omnichannel retail activities. Consumers are showing their willingness to adopt these new technologies and their preference for new ways to interact and pay, but they want great experiences, trusted partners, and transparency. This creates significant opportunities for merchants relying on traditional programs to embrace the digital and data-driven approach and grow their marketplace.

There is a massive market opportunity that continues to expand with the adoption of digital transaction types. From an industry standpoint, there is a rising wave of focus and adoption of eCommerce, POS financing, and digital servicing strategies that are garnering more attention.

SIGN UP FOR OUR NEWSLETTER