Small and medium-sized businesses tend to be helmed by jacks of many trades.

Successful business owners need to have a certain level of comfort with a range of fields: sales, marketing, and finance, at least, and probably HR, legal, and supply chain management, too.

They’re used to figuring things out on the ground. They’re often self-taught, self-made leaders who aren’t afraid to move quickly and break things along the way.

That works with marketing. That might even work with finance. But when it comes to legal and compliance projects, it’s usually worth it for SMBs to look for a partner.

We asked Clyde’s VP of Warranty, Pam Schneider, who has been in insurance for 25 years and warranties for nearly 10, to tell us everything she’d want an SMB considering a warranty program to know.

And then we wrote it all down here for you.

8 questions with Clyde’s Pam Schneider

What have you seen in terms of how SMBs approach exploring things like extended warranties?

Prior to Clyde, Pam Schneider served in a series of executive positions for The Warranty Group, which was one of the world’s leading providers of warranty solutions and related insurance products, with operations in over 35 countries and more than $5 Billion in assets before it was acquired by Assurant.

Pam Schneider: They often are running hard and fast day to day trying to get stuff done. It can be hard for them to come up out of the fray to say, ‘Okay, I need X service or Y capability, and who can I go to to get it?’ Doing the diligence and research and filtering can feel like it’s going to take a lot more time than just doing it themselves.

But it’s not common to see a small- or medium-sized business have success with an in-house warranty program. Many honestly don’t even know about the option to have an extended warranty program to complement their manufacturer warranty or limited warranty, which is the warranty they’re required to have.

As a primer, how would you explain extended warranties to a business owner who is new to them?

An extended warranty program is a way of providing real value. They can give end consumers peace of mind about purchases that are vital to our work and lives. Clyde’s extended warranty model is made up of three parts:

An obligor, or the entity that takes on the risk. If something breaks or needs repair, they’re ultimately responsible for that. In many cases, they’re backed by an insurance company, but they themselves are not necessarily an insurance company. Asurion, for instance, is one of Clyde’s obligors.

An administrator provides claims administration services; in other words, the service arm of the business. In some cases, Clyde is its own administrator and in other cases it leverages a partner’s expertise.

The merchant, who makes the offer to the end consumers. That can be from a regional electronics store to a nationwide conglomerate.

What are some of the risks that come with offering a warranty program?

If you do it in-house, you’re responsible for pricing the product, making the offer, and setting aside funds to pay out claims.

If a product breaks and needs repair, those incidents incur a cost. And if you don't price your warranties appropriately to cover for what's known as the frequency, or the number of claims you get, and the severity, or how much it costs you to resolve that claim, it could put you out of business.

For a small or medium business to do an in-house program without having the expertise, they're kind of betting the farm. In many cases, if not most cases, they’re unknowingly taking a risk that could put them out of business.

The other risks come with the fact that these are regulated products, and how they are marketed and sold is subject to state-by-state regulations. Even an unfounded complaint can absorb a lot of time and energy, with the organization having to respond to a regulatory authority that is investigating a claim from an unhappy customer. It can really take up a lot of resources from an organization. And if the investigation deems that a customer was misled, there can be fines and other repercussions.

How does using an extended warranty partner like Clyde address those risks?

The risk of mispricing is all absorbed by Clyde and its partners, and we work with best-in-class providers in this space that have really robust compliance departments that review all marketing materials and how offers are being made to make sure that they conform with all regulatory provisions.

Our partners also have extensive history on how to price these products. So the margin of error is way smaller, and if they get it wrong, the risk of that is absorbed between Clyde and its partners.

What value can extended warranty programs bring to SMBs? Can they find success despite not being a big-box retailer?

Definitely. The value comes across multiple fronts: it can increase revenue, it can increase loyalty of their customers, it can provide an increased sense of quality and protection that they’re willing to stand by their product and offer this additional coverage, and it can drive repeat purchases.

And these are benefits that have no kind of hard cost outlay at the outset. We typically do not charge any kind of implementation fee or integration fee. They’re plug and play, so SMBs can launch a program in very little time, and there's no cost to them. There’s a bit of time invested, but it’s really minor, and anything they sell goes straight to the top line—and their bottom line.

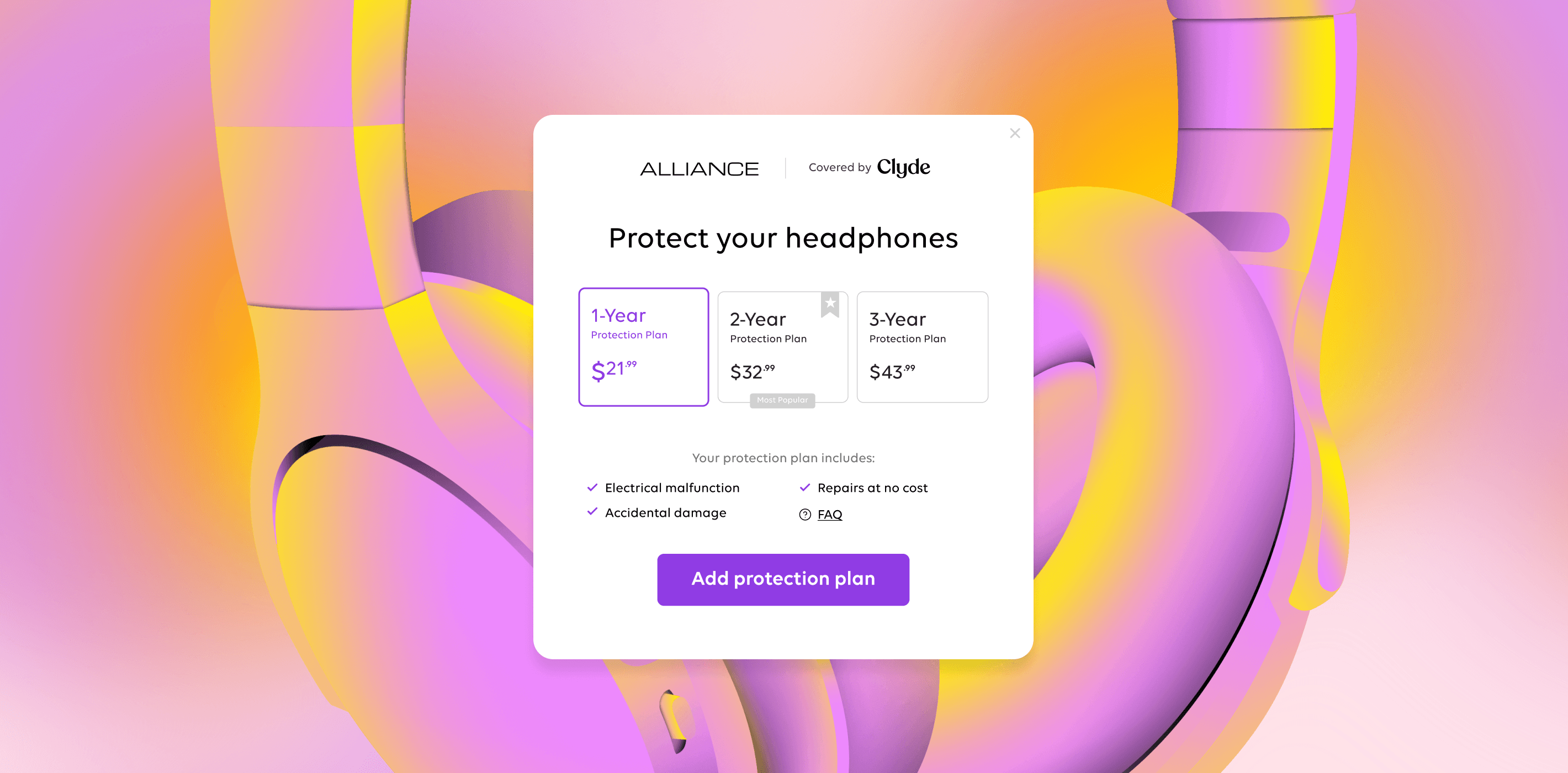

What’s the experience like for a merchant or end consumer using Clyde’s purchase protection plan?

For merchants, when they sign up, they get an implementation consultant along with an account manager, who shepherds them through the process. It’s a fairly turnkey solution, where we provide them with all pre-approved, compliant material via an API that works directly with their platform. I've seen small and medium businesses launch in as quick as two days. It’s just a matter of getting their product catalogue and matching it to the right program.

They can change the sale price to the consumer via a merchant dashboard, where they can see what works best for their consumers from a pricing perspective.

For consumers, they’ll be offered product protection on the product page and in the shopping cart. If they purchase it, they’ll get an email with simple terms and conditions, as well as a link to Hi Clyde, our consumer portal, where they can register and, if their product breaks, submit a claim. Most merchants are hands-off in the claim process, but some want to be kept in the loop. During the claim, Clyde will track the repair or replacement and make sure it’s done in a satisfactory manner.

How is the Clyde experience different from other extended warranty providers?

It’s digital-first. It’s focused on creating a differentiated experience for eCommerce consumers. I previously worked at a warranty company that had old technology that’s hard to transform for the digital world. Clyde is designed for modern business, in a way that creates a lot more flexibility from a technology perspective. It makes it easier to integrate with the shopping platforms. And we own all our IP—we opted to build, not buy or partner—which makes it easier and quicker for us to enhance it and modify it over time.

What advice would you give a SMB who is thinking about offering a product protection or extended warranty program?

I would say you definitely don't want to go it alone, and that it's not a big lift. It's a really simple and easy way to offer an additional service to your customers.

There are providers like Clyde out there that are designed to work with small and medium businesses. It's not a big hill to climb; we can get them up and running in very little time, and they can start providing an additional value to their consumers, with virtually no investment on their part.

And don’t worry! The spam calls you get about auto extended warranties are not reflective of the industry. Our products do provide real value.

Ready to learn more about extended warranties?

Still have questions on how implementing a warranty program can help your SMB drive revenue and customer loyalty? Reach out and let’s get started .

SIGN UP FOR OUR NEWSLETTER