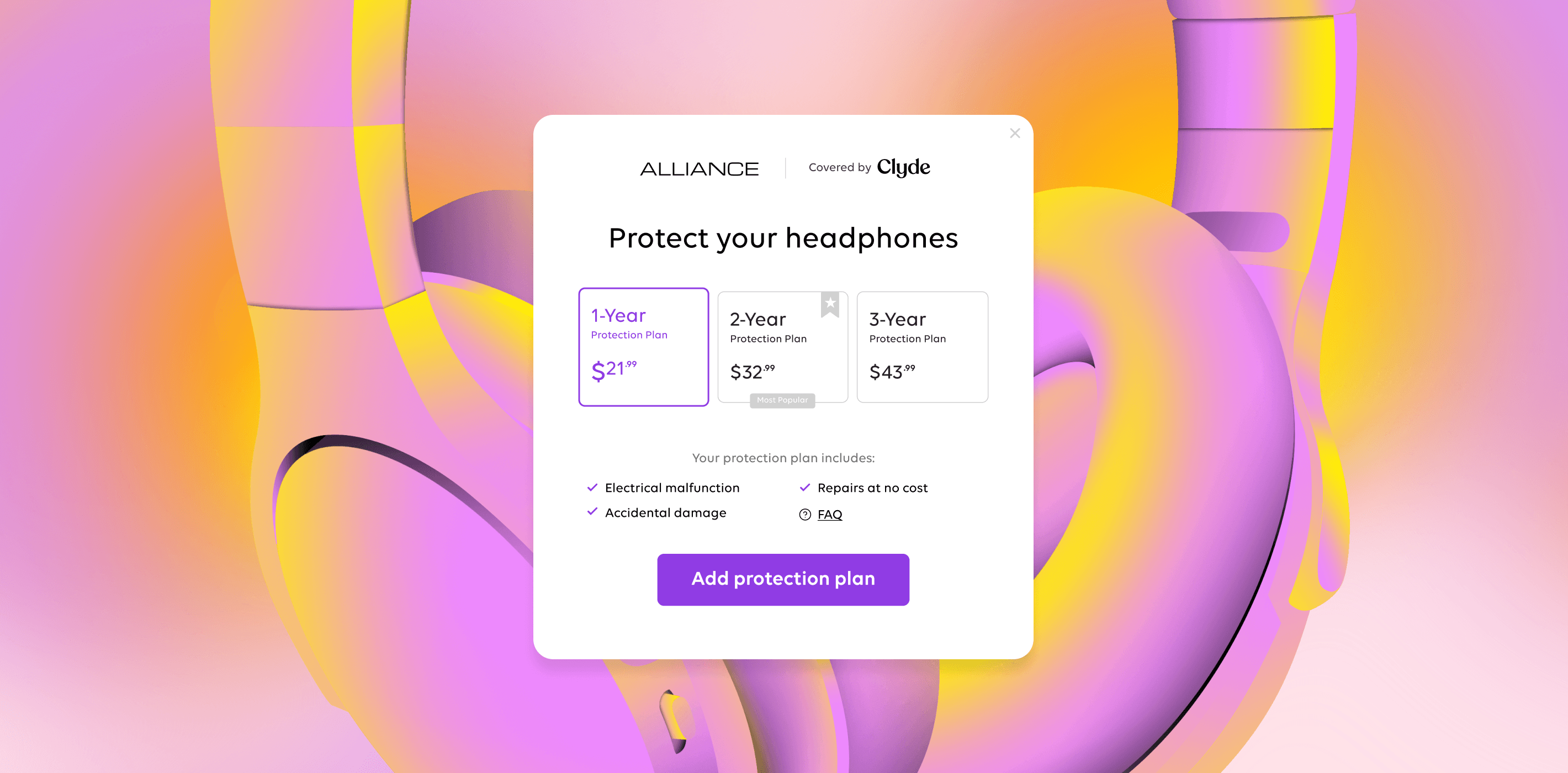

In today’s retail environment, implementing low effort, high return initiatives that drive revenue and customer experience is critical. Hands down, launching a product protection program should be one of those initiatives. As with any initiative, it’s important to consider how you will measure the success of this program and which key performance indicators (KPIs) you should optimize for. Which metrics matter? Which potentially obfuscate the ones that do? Here’s a guide to the metrics that matter, and the questions you need to ask potential partners to make an educated decision.

1. Attach Rate

A key performance indicator of any product protection program is the attach rate. The attach rate tells you what percentage of orders were purchased with an extended warranty or product protection contract. A typical e-commerce attach rate for consumer brands is 4%, though this varies by industry vertical. Over the past few years, as programs have become more transparent and customer friendly, attach rates have increased. Most retailers using Clyde see rates in the double digits. (Read more about our customers’ success here .)

There are multiple levers a partner should be able to use to help optimize your attach rate, including customizable calls to action and automated margin adjustments.

2. Revenue

This one is pretty self explanatory. You should be able to track the amount of revenue you have made over the course of your program without requesting a report from your partner or another department. If a vendor offers a post-purchase program, be sure to ask if revenue can be broken out between time of sale and post-purchase, giving you deeper insight into where you are generating the most revenue. Also make sure to ask how much work is required on your part to activate any of these features.

3. Your Profit

Be sure to fully understand how your profit is calculated, and what your expected profit margins should be. There are three components that drive this: 1) The cost of the contracts you’ll sell to your customers, 2) The “service fees” or “transaction fees” charged by the provider, 3) The price at which other retailers are selling the same types of contracts. Ideally, you should be optimizing for 1) Low contract costs, 2) Low premiums, and 3) the most gross margin possible. Make sure you check to see if your provider is charging you transaction fees on your contract costs or retail price.

4. Contract Sales

Another pretty straightforward metric, contract sales are simply the number of product protection contracts you have sold over a period of time. Once you have enough data, you will be able to see trends in seasonality and better forecast future contract sales. Be sure to ask any potential partners for benchmarks for companies similar to your own. Automated pricing optimization will not be possible without prior examples of businesses in your industry.

5. Claims Response Time

Claims response time tells you how long it typically takes a partner to adjudicate a claim. This is a key part of the customer experience, and reflects on you as a retailer. Make sure a partner has a strong process in place for claim adjudication—because your customers need you most when something goes wrong.

Watch Out!

Claims Approval Rate

The claims approval rate is the number of claims approved divided by the total number of claims submitted. While it should always be the goal to ensure customer satisfaction, the claims approval rate of a vendor does not necessarily provide helpful information. Many claims are submitted during the limited warranty period, and would thus be denied by an extended warranty partner . However, this does not mean that the customer has not been helped and that they will not receive a repair or replacement of their product, it simply means that the retailer will manage this claim under the terms of their limited warranty. What does matter is how these situations are handled to ensure every customer has an effortless experience. If a customer does file a claim during the limited warranty term, Clyde’s platform offers customers a warm handoff to the retailer's support team.

While claims approval rates may seem valuable on the surface, be sure to dig into the reasons why claims are denied or approved.

Over-Emphasis on Automated Adjudication

Auto-adjudication is important, but it’s not the only part of customer communications that matter during the adjudication process. How does the warranty partner handle situations where additional narrative is required to properly assess a claim? How do they manage communications In situations where claims are denied due to the reported issue being covered under your Limited Warranty? During the adjudication process, is your customer success team provided visibility into the claims resolution to provide a better customer experience? These are just a few of the questions you should be asking when digging into how your partner manages claims and ultimately your customer relationships when they need you most.

Customer Account Access

Although it isn't a metric, it's easy to get lost in the numbers without getting a real-time virtual tour of what one of your customers would experience if they needed to use the protection plan they purchased from you. After all, they'll associate that protection plan with your brand, so make sure to get a live demonstration of that experience to ensure you're fully satisfied.

Key Takeaways

A product protection platform should ultimately do two things for your brand: drive incremental revenue and improve the customer experience. Any KPIs you track should point towards these north star goals. When evaluating whether a product protection platform is a priority for you, be sure to understand which performance metrics you are optimizing for, and which a potential partner can track for you. We hope this list of KPIs will serve as a guide and help you to approach any metrics with a skeptical mindset.

SIGN UP FOR OUR NEWSLETTER